TRADITIONAL IRA

Safeguarding Futures, Nurturing Legacies

Understanding Traditional IRAs | 401k Rollovers

A brief overview of what a Traditional IRA is.

Benefits of rolling over a 401k into a Traditional IRA.

Explanation of tax advantages and long-term growth potential.

WHAT IS AN IRA?

Individual retirement account.

Offers tax-deferred growth.

Withdrawals taxable as Ordinary Income.

Contributions may be tax-deductible.

IRA BENEFITS

Tax-Deferred Growth: Investments grow tax-deferred until withdrawals begin.

Potential Tax Deduction: Contributions may be deductible on your federal income tax return.

No Income Limits: Unlike Roth IRAs, there are no income limits for contributing to a Traditional IRA.

Wide Range of Investment Options: Includes stocks, bonds, mutual funds, ETFs, and more.

401k ROLL OVER TO IRA CAN:

Consolidate your retirement savings.

Potentially reduce fees.

Provide more investment options.

TAX CONSIDERATIONS

Traditional IRA Contributions may be tax-deductible

Your investments grow tax-deferred.

Withdrawals in retirement are taxed as ordinary income.

Required Minimum Distributions (RMDs) starting at age 72.

NEW IRA PROCESS

Fill out the application

Designate a beneficiary for your IRA

Decide on your initial contribution method

Set up automatic transfers from your bank account.

Plan for a rollover from another retirement account.

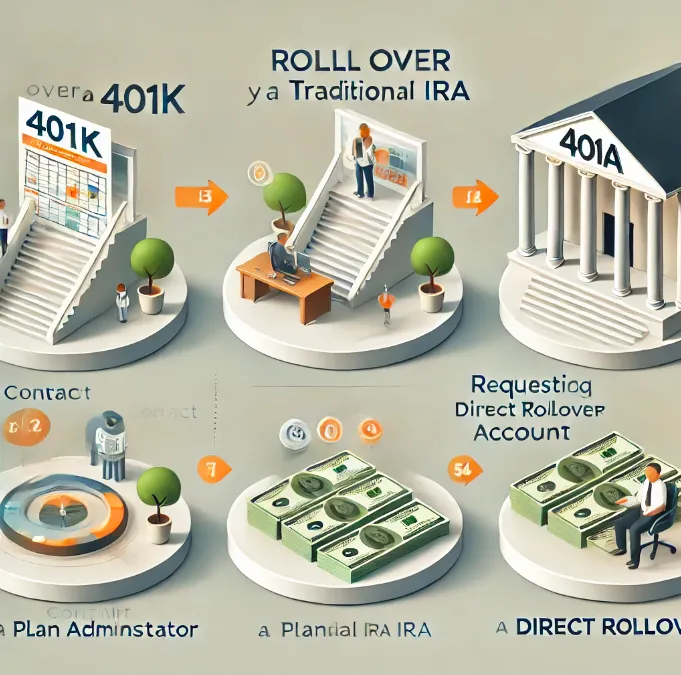

401k ROLL OVER PROCESS

Contact your 401k plan administrator to learn about the rollover process.

Check for any fees or restrictions associated with the rollover.

Choose Direct or Indirect Rollover:

Direct Rollover: Funds are transferred directly from your 401k to your IRA, avoiding taxes and penalties.

Indirect Rollover: You receive a check from your 401k plan and must deposit it into your IRA within 60 days to avoid taxes.

Initiate the Rollover:

Inform your new IRA provider about the rollover.

Complete the necessary paperwork from both your 401k plan and the IRA provider.

For a direct rollover, the 401k plan administrator will send the funds directly to your IRA.

For an indirect rollover, ensure you deposit the check into your IRA within 60 days.

Free Consultation

Speak to an Expert. | Compare your Options | Estimate your Wealth

Testimonial

Don’t take our word for it, hear what our happy clients have to say

Amazing Service. They are very professional and sincere about helping people. I would definitely recommend their consultants to everybody.

Amazing Service. They are very professional and sincere about helping people. I would definitely recommend their consultants to everybody.